Certified Payroll Made Simple: What Contractors Really Need To Know

Certified payroll can feel overwhelming for contractors who work on government-funded or prevailing wage projects. In this article, I break down the certified payroll process in simple, practical language so you understand exactly what’s required each week. You’ll learn how worker classifications, wage rates, fringes, deductions, and the WH-347 form all work together, along with the common mistakes that lead to compliance issues. This guide helps contractors stay organized, avoid penalties, and confidently manage their payroll reporting.

CONTRACTOR ACCOUNTING

Lena Hanna

12/2/20252 min read

Certified payroll is one of the most common sources of stress for contractors. The rules feel complicated, the forms look intimidating, and mistakes can lead to fines, delays, or a loss of eligibility on government projects. But with the right setup and routine, certified payroll becomes a predictable, manageable part of your week.

Let’s walk through it together, calmly and clearly.

What Certified Payroll Actually Is

Certified payroll is a special type of payroll reporting required when you work on federal, state, or local government-funded projects under prevailing wage laws (Davis-Bacon or similar state rules).

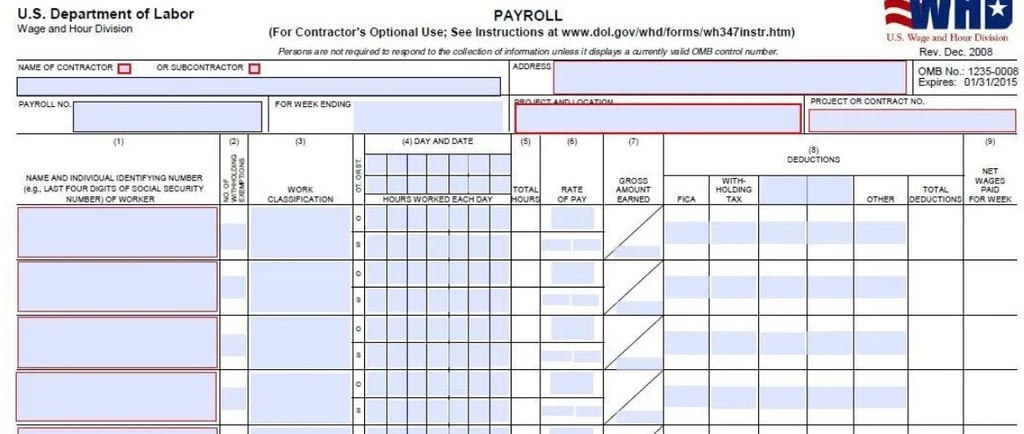

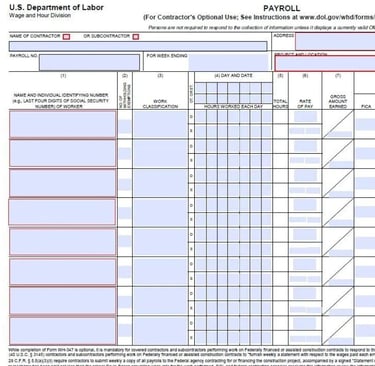

Every week, contractors must submit:

A payroll report showing each worker’s hours, classification, rate, gross pay, deductions, and net pay

A signed statement (the “certification”) confirming the payroll is accurate and complies with prevailing wage laws

The purpose is simple: To ensure workers on government projects are paid fairly and consistently.

Who Needs To File Certified Payroll?

If your company works on:

Federal government-funded jobs

State-funded construction projects

County or city public works

School district projects

Transportation or infrastructure projects then certified payroll is required every single week you are active on the job.

This applies to:

General contractors

Subcontractors

Specialty trades

Laborers

Apprentices

If you are on a public project, you are responsible for reporting your own payroll.

The Most Common Certified Payroll Mistakes I See

After working with many contractors, these are the biggest issues that cause delays, violations, or compliance problems:

1. Incorrect worker classifications

For example: listing a laborer as a carpenter or paying a skilled trade the laborer rate. A small mistake here can lead to serious penalties.

2. Not paying the correct prevailing wage

Prevailing wage includes:

base rate

fringe benefits

possibly cash-in-lieu of fringes

All must be calculated correctly.

3. Missing apprenticeships or ratio rules

If apprentices are on the job, their documentation must match state requirements.

4. Misreporting overtime

Overtime rules differ from standard jobs and must be handled carefully.

5. Submitting late or incomplete reports

Government agencies are strict about weekly filing. Even one late report can hold up payment.

How To Make Certified Payroll Easy (A Simple Routine)

Here’s the workflow I recommend to keep everything clear and stress free:

1. Set up classifications before the job even starts

Match every worker to the correct wage determination so payroll flows smoothly.

2. Track hours accurately by job and classification

Time-tracking apps help, but even structured timesheets work if used consistently.

3. Calculate fringes correctly

Know whether your fringes are paid:

in cash

through benefits

or a mix of both

4. Review reports before submitting

Check:

classifications

hours

overtime

deductions

signatures

5. Submit your WH-347 (or state form) weekly

Consistency prevents delays and compliance issues. Small steps create clarity. Clarity protects your business.

Why Certified Payroll Matters for Contractors

Certified payroll:

keeps you compliant

protects your ability to bid on future public projects

ensures you get paid on time

builds trust with general contractors and agencies

Doing it right isn’t optional — it’s essential. And once your system is set up properly, weekly reporting becomes quick and routine.

You Don’t Have To Do This Alone

If certified payroll feels overwhelming, confusing, or time-consuming, I can help. I work with contractors to:

set up correct job classifications

calculate prevailing wage + fringes

process weekly payroll

prepare certified payroll reports

keep everything compliant

support multi-state or multi-agency projects

A steady system will keep you protected and confident.

If you need support with certified payroll, send me a message anytime. You deserve clean reports, accurate pay, and less stress.

— Lena, LNH CPA PLLC